In today’s fast-evolving financial landscape, lenders face increasing pressure to provide fast, secure, and customer-friendly loan services. Whether it’s banks, NBFCs, microfinance institutions, or digital lenders, managing the entire lifecycle of a loan manually can lead to inefficiencies, delays, and compliance risks. This is where a loan management system becomes essential. These systems automate and streamline the end-to-end loan process—from origination and disbursement to servicing and collections—ensuring accuracy, scalability, and compliance.

A loan management system (LMS) is a powerful tool that not only simplifies internal operations but also enhances the borrower’s experience through faster loan approvals, transparent tracking, and digital interactions. As digital lending gains traction, having a robust and scalable LMS is no longer optional; it’s a necessity for staying competitive and customer-focused.

What is a Loan Management System?

A loan management system is a software platform designed to manage the complete loan lifecycle. It includes features such as borrower onboarding, credit scoring, document management, loan approval, EMI scheduling, payment tracking, delinquency management, and reporting.

These systems are built to support different types of loans—personal, business, mortgage, education, vehicle, or microloans. They can be cloud-based or on-premise and are often integrated with CRMs, accounting tools, payment gateways, and credit bureaus.

Core Features of a Loan Management System

A well-designed LMS brings a variety of features that cater to the needs of both lenders and borrowers. Some of the key features include:

- Loan Origination Module

This allows for automated loan applications, verification processes, and credit scoring. It reduces human error and accelerates decision-making. - Credit Assessment Tools

Integrates with credit bureaus and alternative data sources to provide a comprehensive credit profile of the borrower. - Automated EMI Scheduling

Enables lenders to set up customized repayment schedules and auto-reminders to borrowers. - Payment Gateway Integration

Facilitates digital payment collection, tracking, and reconciliation through various modes including UPI, net banking, and cards. - Delinquency Management

Detects overdue accounts and triggers reminders or escalation protocols automatically. - Loan Servicing and Closure

Manages loan modifications, prepayments, foreclosure, and final settlements with transparency and precision. - Analytics and Reporting

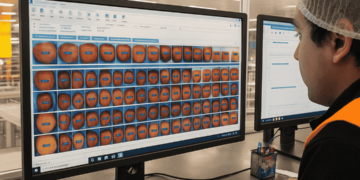

Provides dashboards and customized reports to track portfolio performance, collections, risk metrics, and compliance. - Compliance Management

Ensures that all processes comply with local and international financial regulations such as RBI guidelines, KYC/AML norms, and more. - Multi-Channel Communication

Supports borrower communication via SMS, email, and in-app notifications to keep them informed at every stage.

One notable innovation is the credit line on UPI, which allows borrowers to access short-term loans via Unified Payments Interface—improving financial inclusion and enabling real-time credit usage.

Benefits of Using a Loan Management System

Implementing a loan management system provides a host of operational, financial, and customer-centric benefits:

- Enhanced Efficiency: Automates time-consuming tasks like data entry, payment tracking, and reporting.

- Scalability: Handles large volumes of loan applications and servicing without the need for manual scaling.

- Accuracy: Reduces human error and ensures consistent processing and documentation.

- Faster Turnaround: Enables faster loan approvals and disbursals, improving customer satisfaction.

- Better Risk Management: Real-time data analytics help monitor delinquency and credit risk.

- Improved Compliance: Ensures adherence to financial and regulatory frameworks.

- Cost Savings: Minimizes overhead and operational costs through process automation.

These benefits make an LMS a strategic investment for any lender seeking to grow sustainably and maintain operational excellence.

Industries and Institutions Benefiting from LMS

A loan management system is versatile and can be used by a variety of institutions, such as:

- Banks and Credit Unions

- NBFCs and Microfinance Institutions

- Peer-to-Peer Lending Platforms

- Fintech Startups

- Housing Finance Companies

- Educational Institutions Providing Loans

- Corporate Lenders

Each of these entities requires a tailored LMS that aligns with their unique loan structures, risk appetites, and compliance needs.

Popular Loan Management Systems in the Market

There are several leading LMS platforms known for their robustness and flexibility. Some of the popular ones include:

- LendFoundry – Designed for digital lenders and fintechs with AI-based credit decisioning.

- Nucleus FinnOne – A comprehensive system used by many banks and NBFCs for loan lifecycle automation.

- BankPoint – Best for community banks and credit unions with strong reporting tools.

- TurnKey Lender – Cloud-based platform supporting both small and enterprise-level lenders.

- Temenos Infinity – Combines loan origination, servicing, and core banking functions.

- CloudBankIN – Offers complete digital lending solutions tailored for NBFCs in India.

Choosing the right LMS depends on your business model, the volume of lending, integration needs, and budget.

Key Considerations When Selecting an LMS

Before adopting a loan management system, institutions should consider several factors:

- Customization: Can the system adapt to different loan types and repayment models?

- Integration: Does it integrate smoothly with your CRM, core banking, and payment systems?

- User Experience: Is the interface intuitive for both borrowers and staff?

- Security: Does it comply with data protection standards and encryption protocols?

- Vendor Support: Are onboarding, training, and technical support adequately provided?

- Cost vs ROI: Does the investment align with your long-term lending goals?

Conducting a pilot program and gathering feedback from all stakeholders can aid in making the best decision.

The Future of Loan Management Systems

The evolution of LMS continues with new technologies enhancing their scope and efficiency. Key future trends include:

- AI and Machine Learning: Enabling better credit scoring, risk analysis, and fraud detection.

- Blockchain Integration: Promising secure and transparent loan agreements and transactions.

- Embedded Finance: Allowing non-financial platforms to offer loans via integrated APIs.

- Open Banking: Enhancing access to borrower financial data for improved decision-making.

- Hyperautomation: Combining RPA, AI, and data analytics to automate entire workflows.

As lending becomes more digital and decentralized, the role of LMS will be pivotal in delivering secure, scalable, and customer-friendly services.

Conclusion

A loan management system is the backbone of efficient and modern lending operations. From simplifying back-end processes to delivering a superior customer experience, it empowers financial institutions to scale sustainably, manage risk effectively, and remain competitive in a digital-first world.

With the rise of digital lending, innovative offerings like the credit line on UPI, and increasing compliance demands, investing in a flexible and future-ready LMS is no longer optional—it’s a strategic imperative for any lender aiming for long-term success.