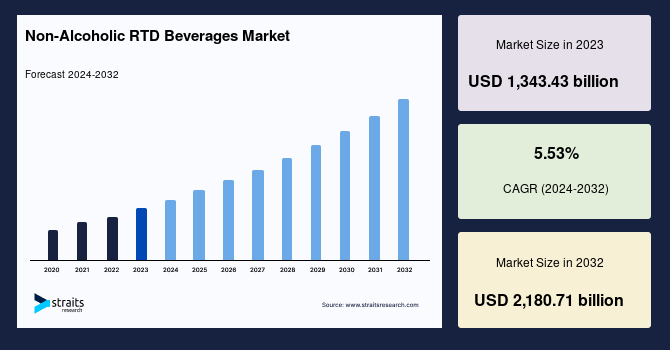

The global non-alcoholic ready-to-drink market beverages is witnessing remarkable growth, driven by evolving consumer lifestyles and shifting preferences towards healthier, convenient drink options. Valued at over USD 1,300 billion in 2023, this market is projected to expand to nearly USD 2,180 billion by 2032, with a compound annual growth rate (CAGR) of around 5.5 percent. This surge signals a profound transformation in beverage consumption patterns, fueled by consumers’ desire for instant refreshment, wellness benefits, and variety.

Market Overview and Key Drivers

Non-alcoholic RTD beverages are defined as pre-packaged, ready-to-consume drinks that do not contain alcohol. They encompass an extensive range of products, including functional beverages, teas and coffees, carbonated soft drinks, fruit and vegetable juices, fortified and flavored waters, as well as dairy-based drinks. The growing demand in this sector hinges on busy lifestyles that necessitate convenient, on-the-go beverages that require no preparation.

A key factor driving growth is the heightened consumer focus on health and wellness. Increasing awareness of the adverse effects of sugary and alcoholic drinks has shifted preferences toward non-alcoholic options that offer nutritional and functional benefits. As health concerns such as obesity, diabetes, and cardiovascular diseases rise worldwide, consumers are gravitating toward beverages fortified with vitamins, minerals, herbs, and probiotics each promising targeted health advantages like immune support, digestive health, or improved hydration.

Rising Popularity of Functional Beverages

Among non-alcoholic RTD categories, functional beverages are experiencing particularly strong demand. These drinks go beyond basic hydration, incorporating health-boosting ingredients designed for specific benefits. For instance, sports drinks formulated for electrolyte replenishment after exercise and probiotic beverages to enhance gut health have grown in popularity. The marketing emphasis on clear labeling and aligning formulas with explicit health benefits resonates with increasingly discerning consumers.

Moreover, the trend toward premiumization is evident in the proliferation of specialty beverages that offer complex flavors and exclusive ingredients, often catering to adult consumers seeking sophisticated alternatives to traditional soft drinks. This trend complements the broader shift toward organic, natural, and clean-label products, meeting the demand for transparency and purity in food and drink.

Expanding Market Segments

The bottled water segment holds the largest share of the non-alcoholic RTD beverages market, with a CAGR of approximately 5.7%. Flavored and fortified water varieties have significantly boosted this category’s growth, as consumers seek hydration with added taste and health benefits often without added calories. Popular flavors include lemon, orange, mixed berries, and apple, with many products enriched with vitamins and minerals.

Carbonated soft drinks, classified under non-alcoholic RTD beverages, are undergoing transformation with the introduction of sugar-free and low-calorie variants to maintain appeal amid declining demand for traditional sugary sodas. However, the overall shift in beverage consumption favors healthier, nutrient-rich options, positioning carbonated drinks as just one part of a diversified market.

Packaging and Distribution Trends

Packaging preferences impact the market notably. Bottles especially glass and plastic dominate due to their durability, aesthetic appeal, and convenience. Meanwhile, cans are rapidly gaining favor, propelled by on-the-go lifestyles and growing environmental concerns encouraging the use of recyclable aluminum packaging.

Distribution channels are also evolving. Retail stores such as supermarkets and hypermarkets remain the primary outlet for non-alcoholic RTD beverages, offering consumers the convenience of one-stop shopping. Simultaneously, e-commerce is gaining traction, providing direct-to-consumer access with increasing penetration expected as online shopping becomes more prevalent.

Regional Growth Insights

The Asia-Pacific region is the largest market and is expected to sustain its growth trajectory with a CAGR of around 5.6%. Factors such as a burgeoning middle class, urbanization, and western lifestyle influences in countries like China, India, and Southeast Asia contribute to this expansion. The health-conscious millennial population significantly drives demand, favoring non-alcoholic RTD beverages as part of a balanced lifestyle.

Europe follows closely, with a similar CAGR propelled by rising health awareness and consumer preference for premium beverages such as specialty teas and coffees. The region embraces products with superior quality and exclusivity, fueling growth in premium segments.

North America is one of the most mature markets, marked by strong consumer demand for convenient, healthful drink options. The trend of reducing alcohol consumption in favor of non-alcoholic alternatives is particularly pronounced, supporting the growth of functional drinks and RTD tea and coffee.

Other regions, including South America, are developing markets where increasing wellness awareness and shifting consumer habits support gradual adoption. The Middle East and Africa currently represent smaller market shares due to low penetration and limited consumer awareness but hold potential for future growth as market infrastructure improves.

Regulatory Landscape and Industry Challenges

The non-alcoholic RTD beverages industry operates under varying regulatory frameworks across countries. While some regions require strict compliance with permits, product registrations, and quality controls such as the robust documentation process for probiotics in the United States others have less stringent oversight. These regulatory disparities can challenge companies seeking global expansion but also encourage innovation in formulation and labeling.

Challenges to market growth include logistics complexity for perishable functional beverages and competition from emerging alternatives like homemade drinks and freshly prepared beverages. Moreover, balancing product innovation with cost-effective production remains critical in meeting consumer price expectations.

Future Outlook

Looking ahead, the non-alcoholic RTD beverages market is poised for continued robust growth. Consumer trends toward health, sustainability, and convenience are expected to deepen. Innovation in ingredients particularly plant-based, fortified, and organic options along with advances in packaging sustainability, will shape the market’s evolution.