Payroll errors can cause serious issues for businesses, employees, and freelancers. From miscalculations to compliance issues, mistakes in payroll processing can lead to penalties, unhappy employees, and financial losses. Fortunately, using a free paycheck creator can help businesses and self-employed individuals avoid these errors while ensuring accurate and efficient payroll management.

In this article, we will discuss the most common payroll mistakes, how a free paycheck creator can prevent them, and best practices for ensuring error-free paystubs.

Common Payroll Errors and How to Avoid Them

1. Incorrect Employee Information

A small mistake in employee details, such as name, Social Security number, or address, can lead to errors in tax filing and paycheck processing. To avoid this:

- Double-check all employee details before generating paychecks.

- Use a free paycheck creator with built-in validation features.

- Keep employee records updated to reflect any changes.

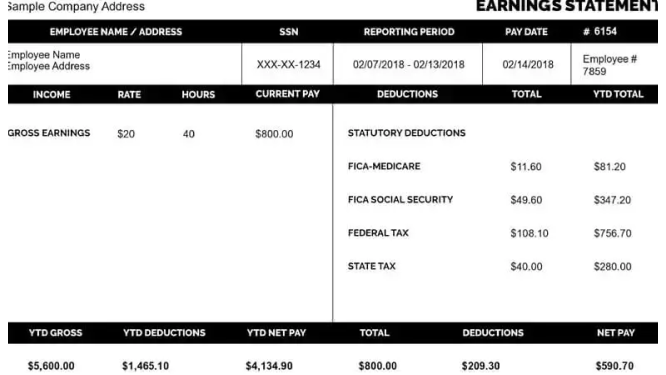

2. Miscalculating Wages and Deductions

Errors in wage calculations and deductions can result in employees being overpaid or underpaid. To prevent this:

- Use a paycheck creator free tool that automatically calculates wages, taxes, and deductions.

- Ensure that overtime, bonuses, and deductions are correctly entered.

- Regularly review payroll records for accuracy.

3. Failing to Deduct Taxes Properly

Employers must deduct the correct amount of taxes, including federal, state, and local taxes. Failing to do so can lead to IRS penalties.

- Use a free paycheck creator that calculates tax deductions based on the latest tax regulations.

- Verify tax rates regularly to ensure compliance.

- Keep track of payroll tax deadlines.

4. Missing Payroll Deadlines

Late paychecks can damage employee trust and lead to compliance issues. To ensure timely payments:

- Schedule payroll in advance using an automated paycheck creator.

- Set up reminders for pay periods and tax filing deadlines.

- Maintain a payroll calendar for better organization.

5. Not Keeping Proper Payroll Records

Payroll records are crucial for tax filing and audits. Losing or failing to maintain these records can create complications.

- Use a free paycheck creator that stores digital copies of paystubs.

- Keep records for at least three years, as required by labor laws.

- Organize payroll files securely, whether digital or paper-based.

6. Incorrect Classification of Employees

Misclassifying workers as independent contractors instead of employees can result in tax and legal issues. To avoid this:

- Understand the difference between employees and contractors.

- Use a paycheck creator free tool that allows for different worker classifications.

- Verify classification status with tax professionals if unsure.

7. Overlooking Overtime Pay

Failing to account for overtime wages can lead to wage disputes and potential lawsuits.

- Use a paycheck generator that includes overtime calculations.

- Ensure compliance with the Fair Labor Standards Act (FLSA) regarding overtime pay.

- Keep track of employee work hours accurately.

8. Errors in Benefit Deductions

Incorrect deductions for benefits such as health insurance, retirement plans, and garnishments can cause paycheck discrepancies.

- Use a paycheck creator free tool that allows for custom deductions.

- Confirm deduction amounts with employees regularly.

- Review benefit plans for any updates or changes.

How a Free Paycheck Creator Can Help Prevent Payroll Errors

A free paycheck creator simplifies payroll processing, reducing the risk of human errors. Here’s how:

1. Automated Calculations

- Ensures accurate wage and tax computations.

- Automatically applies deductions, overtime pay, and bonuses.

- Reduces manual errors caused by miscalculations.

2. Easy-to-Use Templates

- Provides pre-designed templates for quick paycheck generation.

- Customizable paystubs that meet business needs.

- Ensures professional-looking documents for tax and financial purposes.

3. Instant Paycheck Generation

- Eliminates the wait time associated with manual payroll processing.

- Allows businesses and freelancers to generate paystubs instantly.

- Provides downloadable and printable options for convenience.

4. Tax Compliance Assistance

- Integrates tax rules and deductions based on updated IRS guidelines.

- Helps users stay compliant with state and federal payroll laws.

- Minimizes the risk of tax-related penalties and audits.

5. Secure Record-Keeping

- Digitally stores payroll records for easy access.

- Reduces the risk of losing important financial documents.

- Simplifies payroll audits and tax filing.

Best Practices for Error-Free Payroll Processing

Using a free paycheck creator is a great way to prevent payroll mistakes, but following best practices ensures even greater accuracy:

1. Double-Check All Entries

Before generating a paycheck, review all employee details, payment amounts, and deductions to avoid errors.

2. Stay Updated on Payroll Regulations

Payroll laws change frequently, so staying informed about tax rates, labor laws, and compliance rules is essential.

3. Keep Employee Records Updated

Ensure that any changes in employee status, benefits, or personal details are reflected in the payroll system.

4. Schedule Payroll Audits

Regularly review payroll records to identify and correct any discrepancies before they become major issues.

5. Use Reliable Payroll Software

Choosing a reputable free paycheck creator ensures accuracy, compliance, and efficiency in payroll management.

Conclusion

Payroll errors can lead to financial losses, employee dissatisfaction, and legal complications. However, using a free paycheck creator simplifies the process, ensuring accurate paychecks with minimal effort. By automating calculations, ensuring tax compliance, and providing instant paycheck generation, these tools help businesses, freelancers, and independent contractors manage payroll efficiently.

By following best practices and using a free paycheck creator, you can avoid common payroll mistakes and focus on growing your business with confidence.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?