Businesses and individuals facing mounting debts can turn to [Insolvency Practitioners]. Debt relief.

[Insolvency Practitioners] are certified professionals who assist businesses and individuals in managing debt crises.

From small businesses to global corporations, [Insolvency Practitioners] offer customized solutions.

Hiring [Insolvency Practitioners] means receiving expert guidance through financial uncertainty. insolvent Business Process.

For individuals, services like [Personal Insolvency Advice] create a path toward a debt-free future.

If your business is consistently missing payments or facing legal notices, it’s time to seek help.

Ignoring financial issues often leads to court proceedings, asset seizures, and reputational damage. Insolvency Practitioner fees.

Many believe that [Insolvency Practitioners] are only for bankrupt companies.

Some people assume that these services are expensive, but they are often cost-effective in the long run.

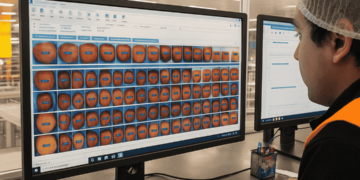

[Insolvency Practitioners] analyze debts, assets, and cash flow before recommending a tailored solution. Personal insolvency.

They ensure compliance with regulatory standards while protecting clients’ long-term interests.

An entrepreneur facing overwhelming personal debt turned to [Personal Insolvency Services] for a fresh start.

Businesses that consult [Insolvency Practitioners] gain clarity, control, and customized solutions. Winding up a company.

Look for professionals with proven expertise in [Personal Insolvency Consultation].

Transparency and mutual trust should guide your selection process.

Be ready to discuss services like [Debt Resolution Plans] to explore the best options. Moratorium definition.

Preparing questions about potential outcomes, costs, and timelines ensures productive consultations.

[Insolvency Practitioners] offer expert guidance to navigate even the most complex challenges.

With the right professionals by your side, financial recovery becomes achievable. Insolvency Consultants.