Financial advisors often work independently, managing multiple clients and earning income from various sources. Unlike salaried employees, independent financial advisors must track their income, handle taxes, and generate proof of earnings. Keeping financial records organized is crucial for budgeting, tax filing, and securing loans.

A paycheck creator free tool simplifies this process by helping financial advisors generate pay stubs, calculate earnings, and maintain professional financial records. In this blog, we’ll explore how financial advisors can benefit from a paycheck creator, its features, and why it’s essential for independent professionals.

Why Financial Advisors Need a Paycheck Creator Free Tool

Financial advisors provide expert guidance on investments, retirement planning, and wealth management. However, unlike traditional employees, they may:

✔ Earn commission-based income from clients

✔ Work as freelancers or independent contractors

✔ Have variable income streams each month

✔ Need to file self-employment taxes

Since they don’t receive regular paychecks, tracking income accurately is essential. A paycheck creator free tool helps financial advisors maintain financial stability by generating pay stubs that provide a clear record of earnings.

Challenges of Tracking Independent Income

1. Irregular Income Streams

Unlike salaried employees, financial advisors often have fluctuating earnings based on client work, commissions, and performance-based incentives.

✅ Solution: A paycheck creator allows advisors to document income consistently, making it easier to track financial trends.

2. Difficulty in Proof of Income

Financial advisors may need proof of income for:

- Loan applications

- Renting or buying property

- Business funding

✅ Solution: A paycheck creator generates professional pay stubs that serve as official income verification.

3. Tax Management Issues

Independent financial advisors must handle:

- Self-employment taxes

- Quarterly tax payments

- Deductions for business expenses

✅ Solution: A paycheck creator helps track taxable earnings and deductions for accurate tax filing.

4. Managing Multiple Client Payments

Financial advisors may receive payments from different sources, making it hard to track total income.

✅ Solution: A paycheck creator organizes income sources and provides clear records of all payments.

How a Paycheck Creator Free Tool Helps Financial Advisors

A paycheck creator free tool offers a simple way to manage financial records. Here’s how:

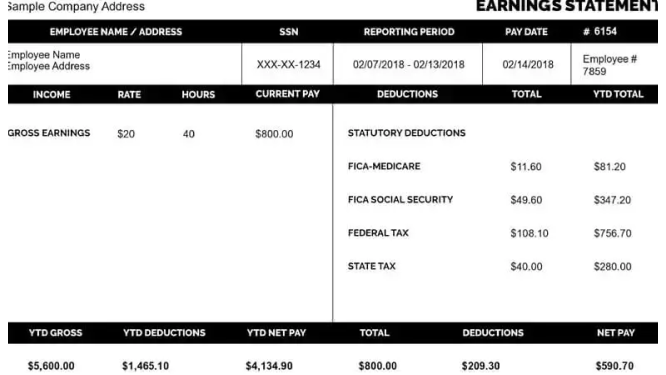

1. Generates Instant Pay Stubs

- Create detailed pay stubs in minutes

- Include earnings, commissions, and deductions

- Keep records for tax and financial planning

2. Automates Income Tracking

- Document each client payment

- Track monthly and yearly earnings

- Organize financial records for better money management

3. Helps with Tax Preparation

- Automatically calculate tax withholdings

- Keep track of deductions and expenses

- Prepare accurate reports for tax season

4. Improves Financial Planning

- Provides clear proof of income

- Helps in budgeting and saving

- Supports loan and mortgage applications

5. Reduces Administrative Work

- No need to manually track payments

- Generates error-free records

- Saves time on financial documentation

Key Features of a Paycheck Creator Free Tool for Financial Advisors

A paycheck creator provides essential features tailored to independent professionals:

✔ Customizable Pay Stubs – Add earnings, taxes, and deductions

✔ Professional Formatting – Generate clean, official-looking documents

✔ Tax Calculation – Automatically compute self-employment taxes

✔ Multiple Payment Records – Track different income sources in one place

✔ Easy PDF/Print Options – Save and share pay stubs when needed

How to Use a Paycheck Creator Free Tool

Step 1: Enter Personal and Business Information

- Full name and contact details

- Business name (if applicable)

- Pay period (weekly, bi-weekly, or monthly)

Step 2: Input Earnings and Payment Details

- Client payments and commissions

- Any bonuses or additional income

- Business deductions or expenses

Step 3: Include Tax and Benefit Deductions

- Federal and state tax estimates

- Social Security and Medicare contributions

- Retirement or healthcare deductions

Step 4: Generate and Save the Pay Stub

- Review for accuracy

- Save as a PDF or printed copy

- Use for tax filing or financial verification

Why Every Financial Advisor Should Use a Paycheck Creator Free Tool

A paycheck creator is a must-have tool for independent financial advisors because it:

✔ Simplifies Income Tracking – No need for complex spreadsheets

✔ Ensures Accurate Tax Payments – Helps avoid IRS penalties

✔ Provides Proof of Earnings – Useful for loans, rent, and legal documentation

✔ Reduces Financial Stress – Keeps all income records in one place

Whether working solo or managing a team, financial advisors can stay organized, save time, and improve financial transparency with a paycheck creator.

Final Thoughts

Managing independent income as a financial advisor can be challenging, but a paycheck creator free tool makes it easier. By generating pay stubs, tracking income, and preparing for taxes, financial advisors can take control of their earnings with confidence.

If you’re an independent financial advisor, start using a paycheck creator today to stay financially organized and stress-free!