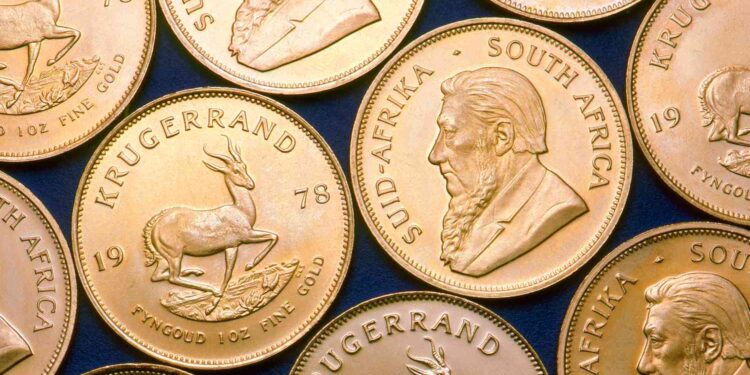

In times of economic uncertainty, smart investors look for ways to protect their wealth. One of the most reliable options continues to be physical gold—and among gold coins, the Krugerrand stands out for its global recognition, value retention, and liquidity.

Introduced in 1967 by South Africa, the Krugerrand was the world’s first modern bullion coin. Its reputation has only grown since then. With a full troy ounce of gold content and a strong resale market, Krugerrands offer a practical and powerful addition to any investment portfolio.

If you’re considering expanding your assets with physical gold, you can buy Krugerrand from trusted dealers offering authentic, investment-grade coins.

Why Krugerrands Are a Trusted Choice

Krugerrands are made from 22-carat gold, containing one full troy ounce (31.1035 grams) of pure gold. The rest of the coin consists of copper, which gives it durability and a distinct reddish hue.

Unlike many coins that are sold mainly as collectibles, Krugerrands are designed for investors. They are valued based on the gold content and market price, not rarity or design. This makes them easy to price, easy to sell, and simple to understand.

Because they are internationally recognised, you can sell Krugerrands quickly in most global markets. That kind of liquidity is a huge advantage in volatile times.

Gold as a Hedge Against Inflation

Gold has long been considered a hedge against inflation. When the value of paper currencies falls, gold tends to hold its purchasing power. This is especially important if your portfolio is heavily weighted in cash, bonds, or equities, all of which can suffer during inflationary periods.

Krugerrands give you direct exposure to the value of gold. Unlike gold ETFs or mining stocks, physical gold is not affected by third-party risks. You own the asset outright. There’s no counterparty involved—just you and your coin.

This makes Krugerrands an attractive option for anyone looking to balance risk in their investment strategy.

Portfolio Diversification Made Easy

Diversification reduces risk by spreading your investments across various asset types. A well-balanced portfolio might include property, stocks, bonds, and commodities like gold.

Krugerrands offer an accessible way to include physical gold in your holdings. They are available in various sizes—from 1/10 oz to 1 oz—so you can tailor your investment to your budget and goals.

By holding gold alongside other assets, you reduce the impact of market volatility. When stocks drop, gold often rises or remains stable. This can help smooth out returns and protect your capital during downturns.

Resale Value and Global Demand

Because of their worldwide recognition, Krugerrands are easy to liquidate when needed. Most gold dealers, jewellers, and even banks will buy them back at rates close to the spot price of gold.

There’s also a large secondary market, so you’re not limited to one or two outlets when selling. This flexibility gives investors peace of mind.

In addition, Krugerrands tend to sell with lower premiums compared to some other bullion coins, such as the American Eagle or Canadian Maple Leaf. That makes them more cost-effective to buy and sell, especially in larger quantities.

Practical Storage and Security

Unlike bulky assets such as property or even silver, gold coins are compact and easy to store. A small safe can hold significant value in Krugerrands, allowing for secure and discreet storage at home or in a safety deposit box.

If you prefer, many dealers also offer professional vaulting services. These are fully insured and allow you to store your coins off-site while still retaining ownership and access.

Whether you store them yourself or use third-party vaults, having physical gold in coin form gives you control. There’s no waiting period or clearance process—your asset is yours from day one.

No VAT and Flexible Sizing

Investment-grade gold, including Krugerrands, is VAT-free in the UK. That gives buyers more value upfront, especially when compared to silver or collector coins, which can include hefty tax charges.

You can also buy Krugerrands in fractional sizes—such as 1/2 oz, 1/4 oz, or 1/10 oz. This adds flexibility to your strategy, allowing you to sell portions of your investment rather than an entire ounce at a time.

Whether you’re planning for the long term or building an emergency fund in gold, fractional Krugerrands give you more options.

Ideal for Long-Term Wealth Preservation

Krugerrands are not about quick returns. They’re about preserving purchasing power and securing your future. Over time, gold has consistently outpaced inflation, making it an ideal long-term store of value.

If you’re thinking about retirement planning, legacy building, or even just peace of mind, adding Krugerrands to your portfolio helps create stability. You’re holding an asset that has been trusted for generations.

FAQs

Are Krugerrands legal tender?

Yes, Krugerrands are legal tender in South Africa, but they do not carry a face value. Their worth is based entirely on the current market price of gold.

Is it better to buy Krugerrands or gold bars?

It depends on your goals. Krugerrands offer more flexibility and are easier to resell in smaller amounts. Gold bars might offer slightly lower premiums for large-volume investments.

Can I store Krugerrands at home?

Yes, you can store Krugerrands at home in a secure, fireproof safe. For added protection, some investors use insured vaulting services offered by dealers or banks.

Do Krugerrands lose value?

Krugerrands can fluctuate in value based on the gold price, but they tend to retain strong long-term value. Their international demand and pure gold content make them a resilient asset.